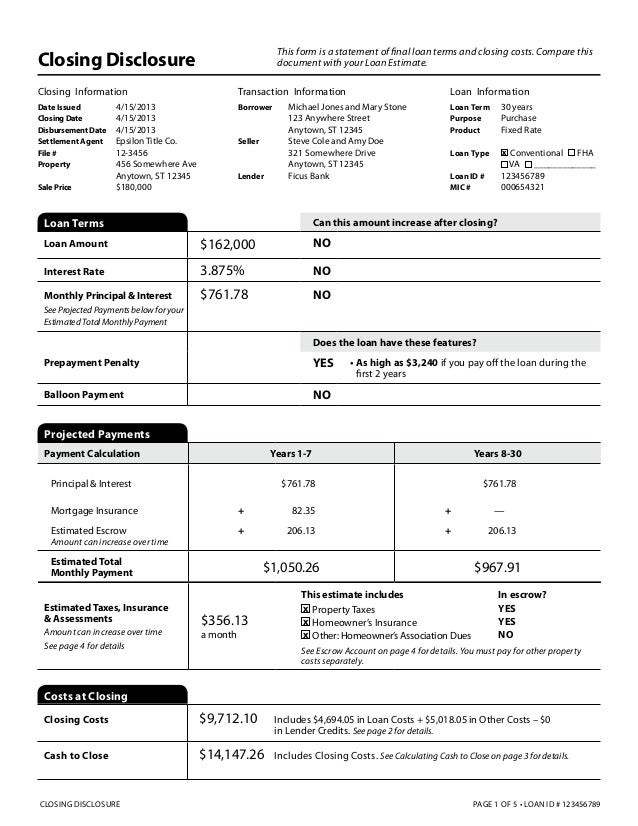

30 yr mtg loans or 60 low monthly payments *special disclosures. The loan estimate is provided within three business days from application, and the closing disclosure is provided to consumers three business days before loan consummation.

Understanding Finance Charges For Closed-end Credit

The closing disclosure must be in writing.

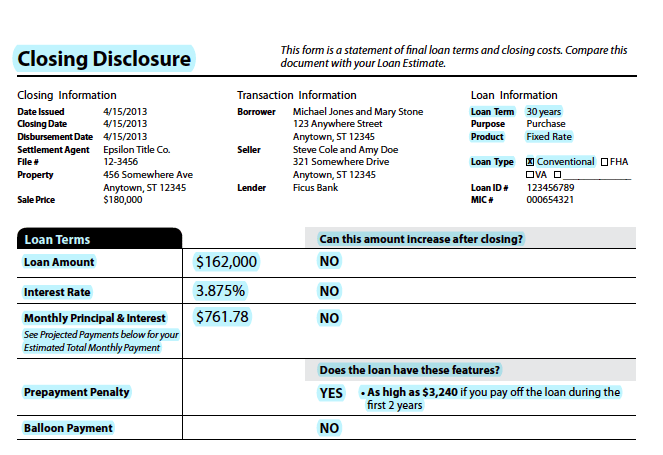

Closed end loan disclosures. Your lender is required by federal law to give you the standardized closing. When will you receive it? Corwin, esquire gordon feinblatt llc 233 east redwood street baltimore, maryland 21202

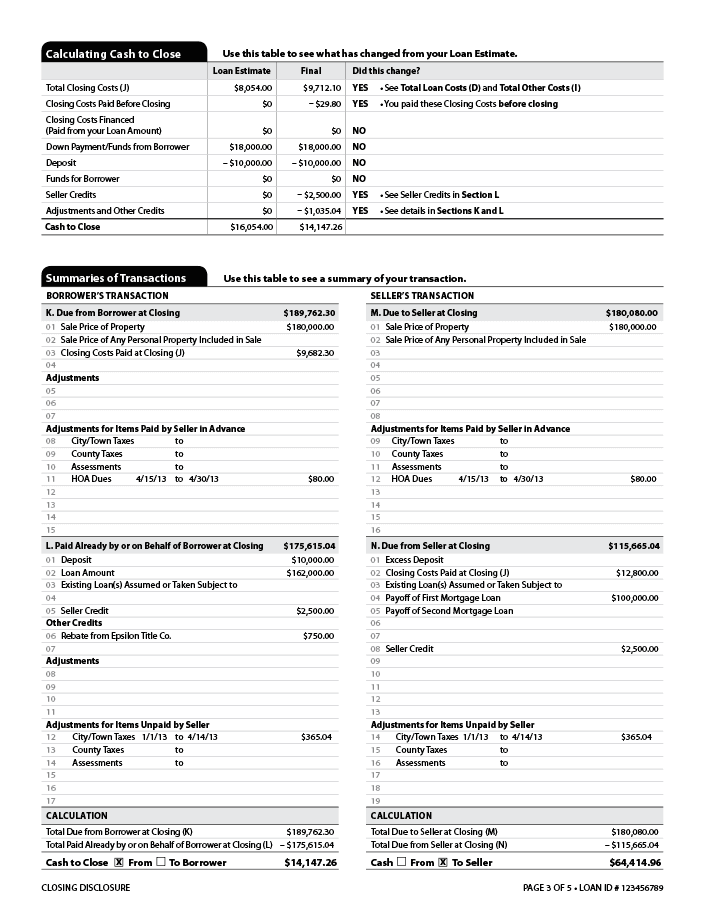

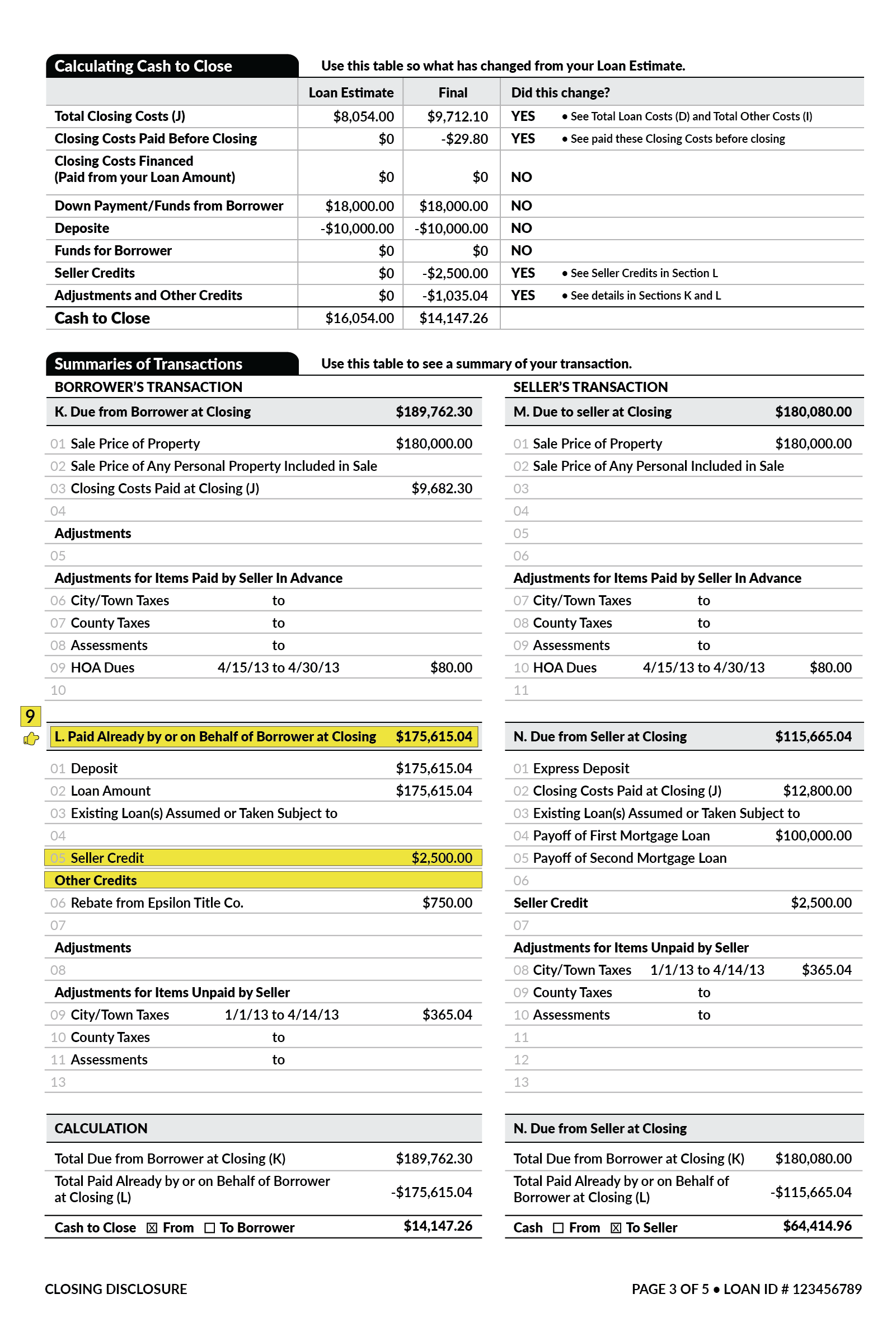

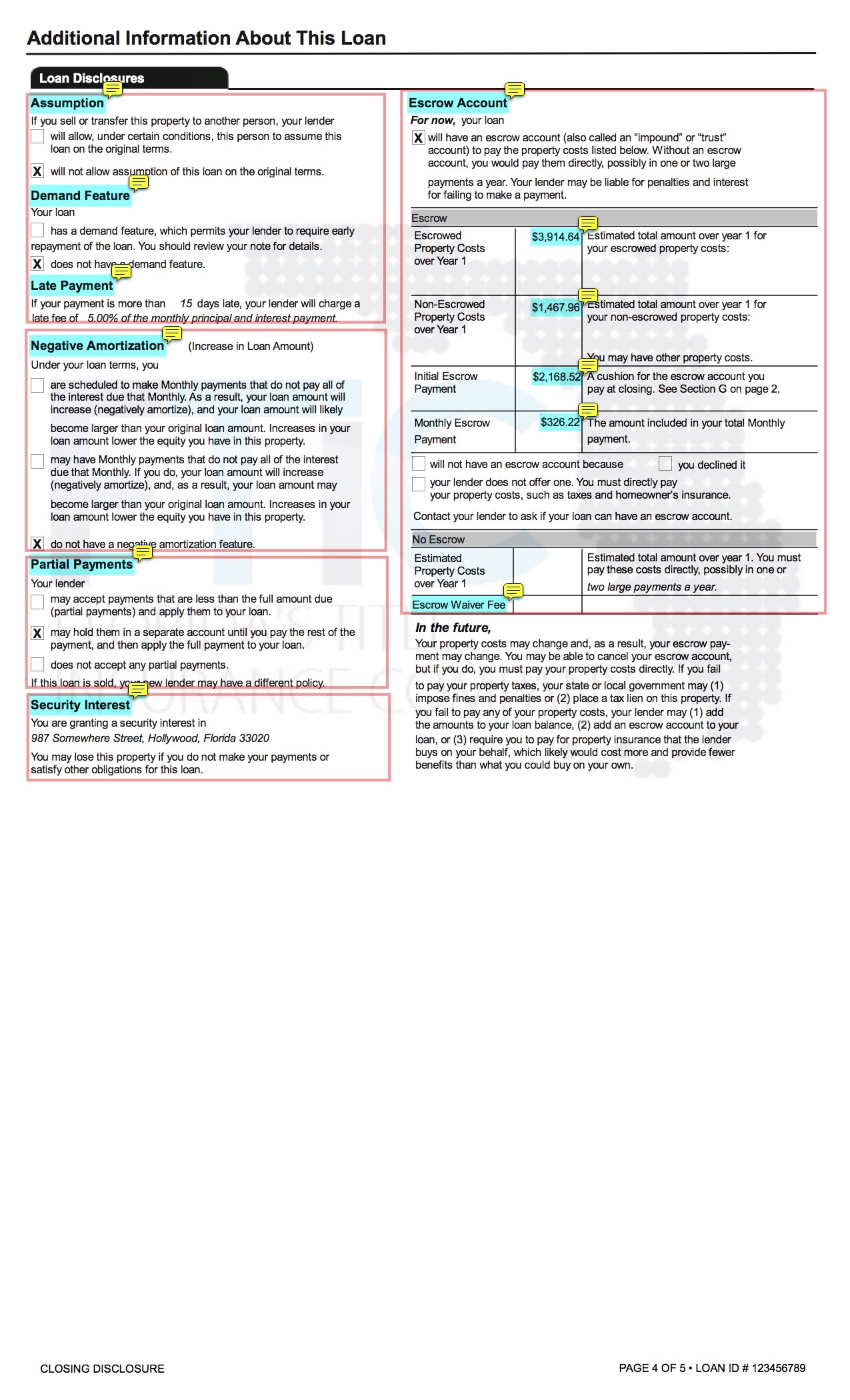

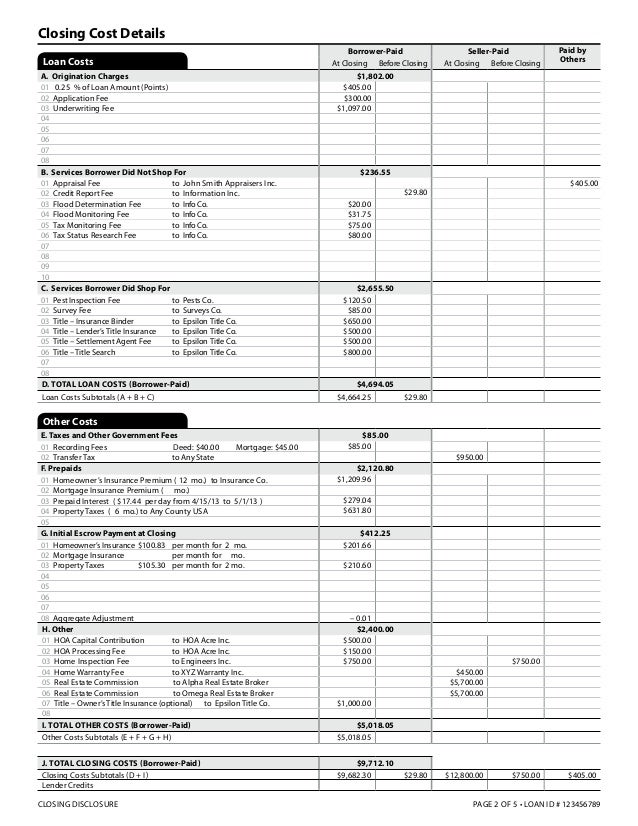

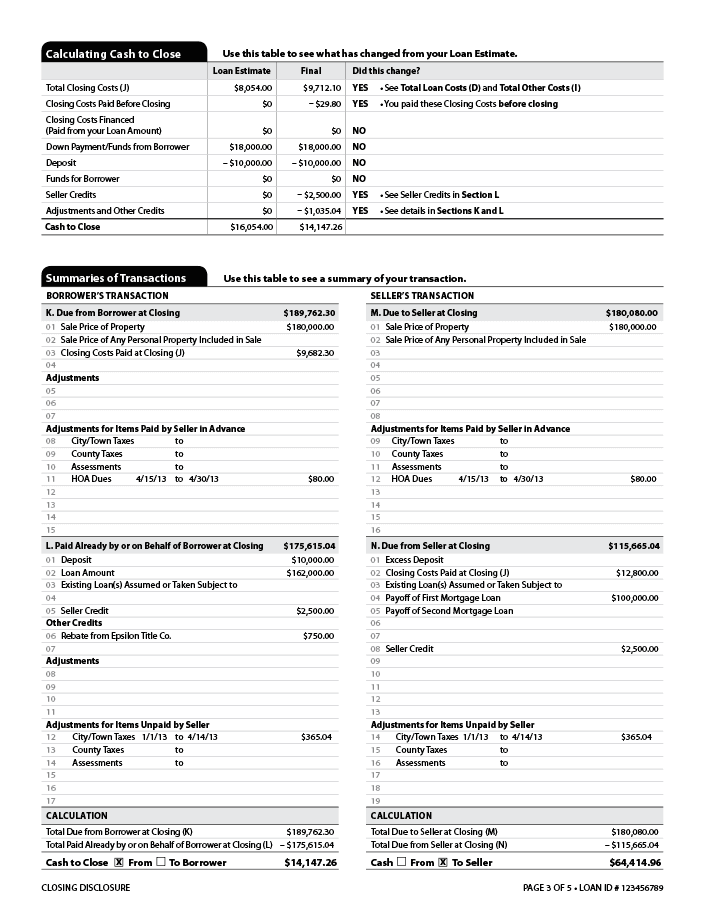

For terminated loans subject to 2 above, an adjustment will not be ordered if the violation occurred in a transaction consummated more than two years prior to the date of the current examination. Which current lender disclosures do the trid forms replace? The closing disclosure walks you through important aspects of your mortgage loan, including the purchase price, loan fees, interest rate, real estate taxes, closing costs and other expenses.

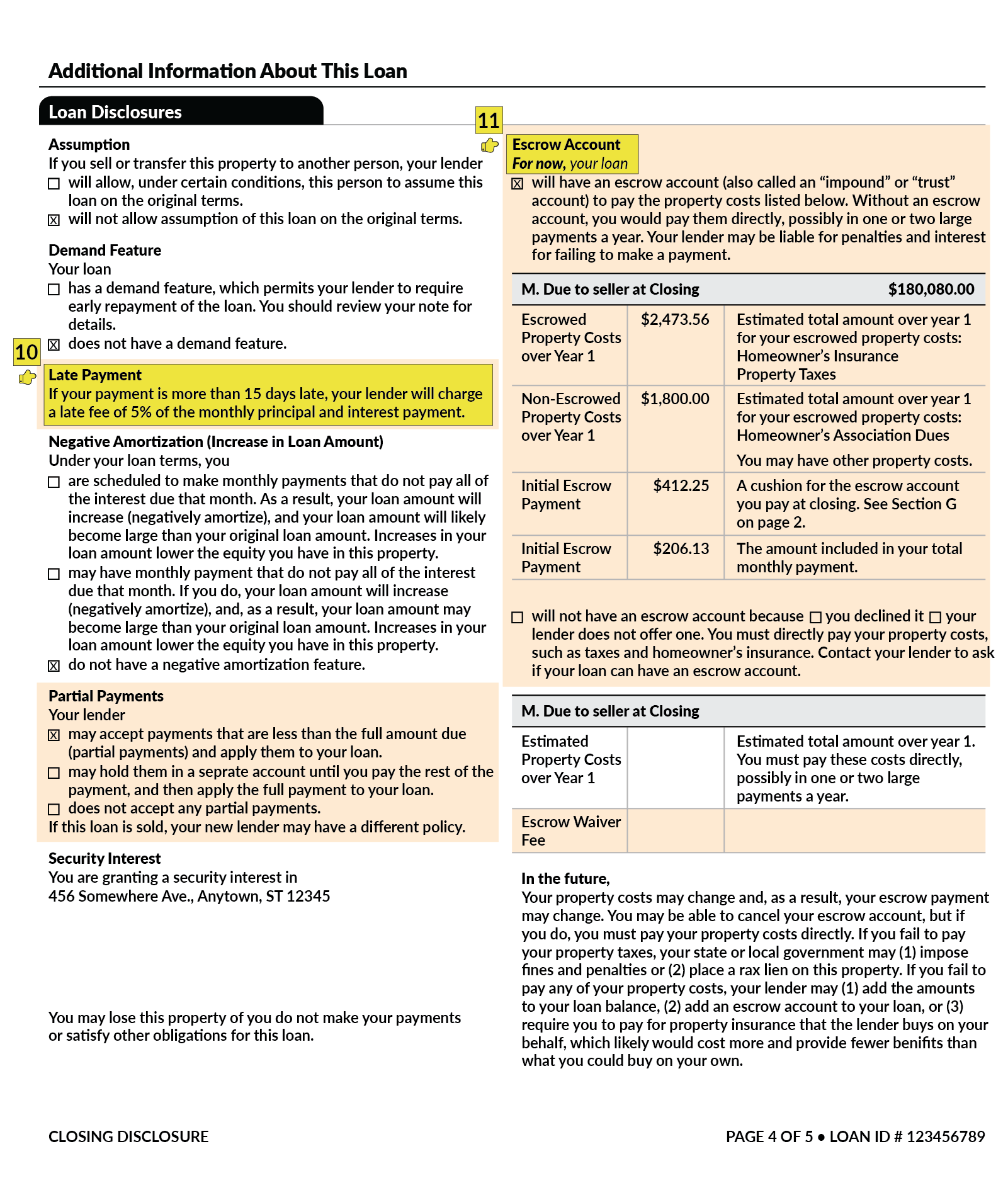

These disclosures must be used for mortgage loans. If this is a variable rate loan, the loan amount section as set forth in the closed end loan disclosure statement tells you whether, if the interest rate increases, you will have to make more payments, higher payments, or if the final payment will be a balloon payment. These disclosures must be used for mortgage loans for which the creditor or mortgage broker receives an application on or after august 1, 2015.

Number of payments or repayment period. Disclosures under § 1026.9(d) when a finance charge is imposed at the time of the. A trigger term is an advertised term that requires additional disclosures.

Missing “additional disclosures” on auto loans (1) triggering terms. Amount or percentage of any down payment (2) the number of payments or period of repayment;

(1) the amount or percentage of any downpayment; (a) the following disclosures need not be written: The purpose, product, sale price, loan amount, loan term, and interest rate have not changed from the estimates provided on the loan estimate.

Home equity lines of credit, reverse mortgages, and mortgages secured by a mobile home or by a dwelling (other than a cooperative unit) that is not attached to real property (i.e., Triggering terms that require *s. At least three business days before.

§ 06.20.285(d) alaska small loans act no. Disclosure section of the closed end loan disclosure statement. For residential mortgages and extensions of credit secured by the member’s dwelling, the disclosures must be provided within three (3) business days after receiving the

Closing disclosure is provided to consumers three business days before loan consummation. If seller has closed 10 loans in last 5 months across the state using different In all such cases, the creditor is not subject to the requirements of § 1026.18(g).

What To Know About The Loan Estimate Closing Disclosure Cd -

What Is A Closing Disclosure Lendingtree

Appendix G To Part 1026 Open-end Model Forms And Clauses Consumer Financial Protection Bureau

The Know Before You Owe Rule What It Means For The Mortgage Process

What Is A Closing Disclosure Lendingtree

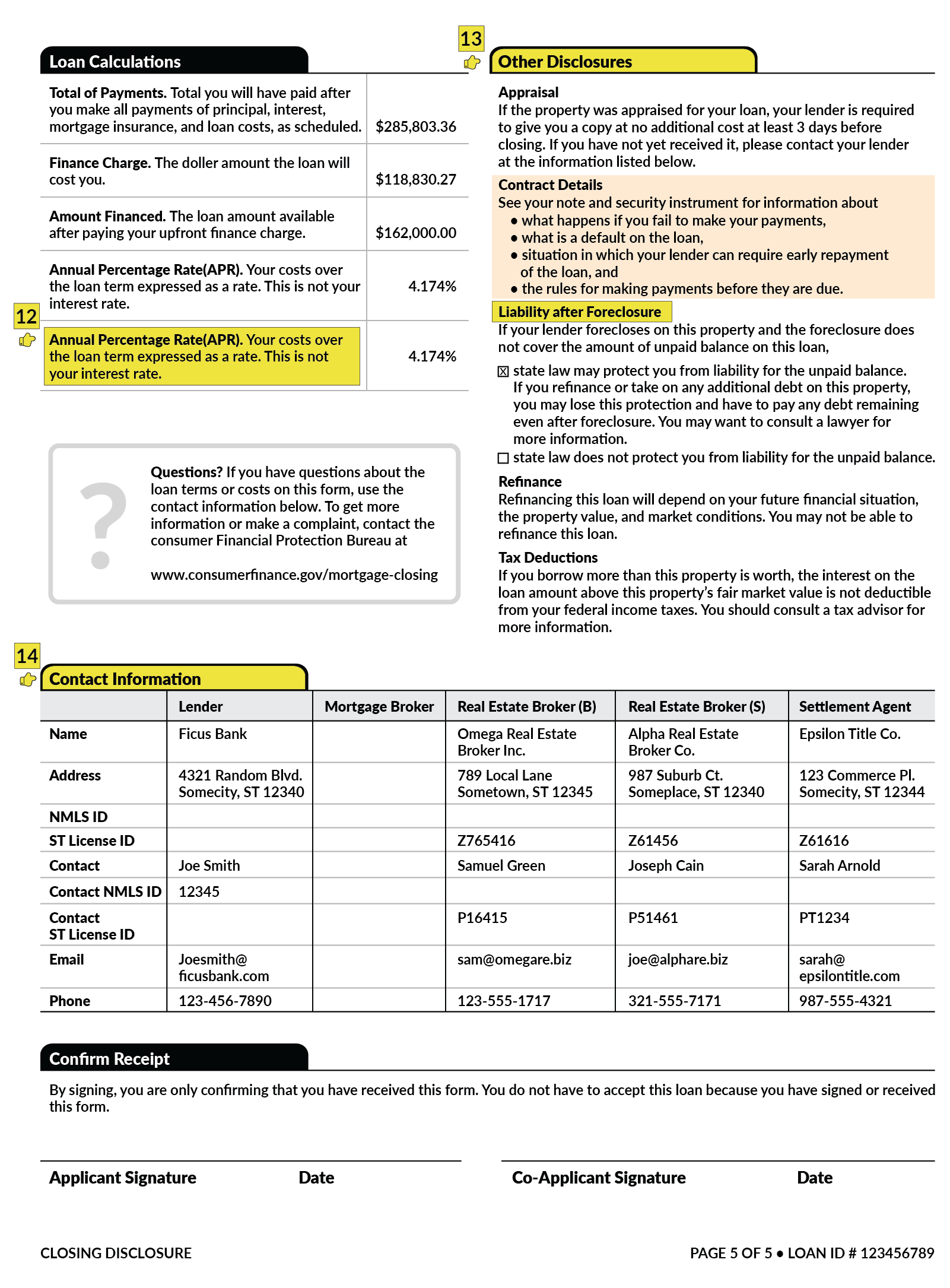

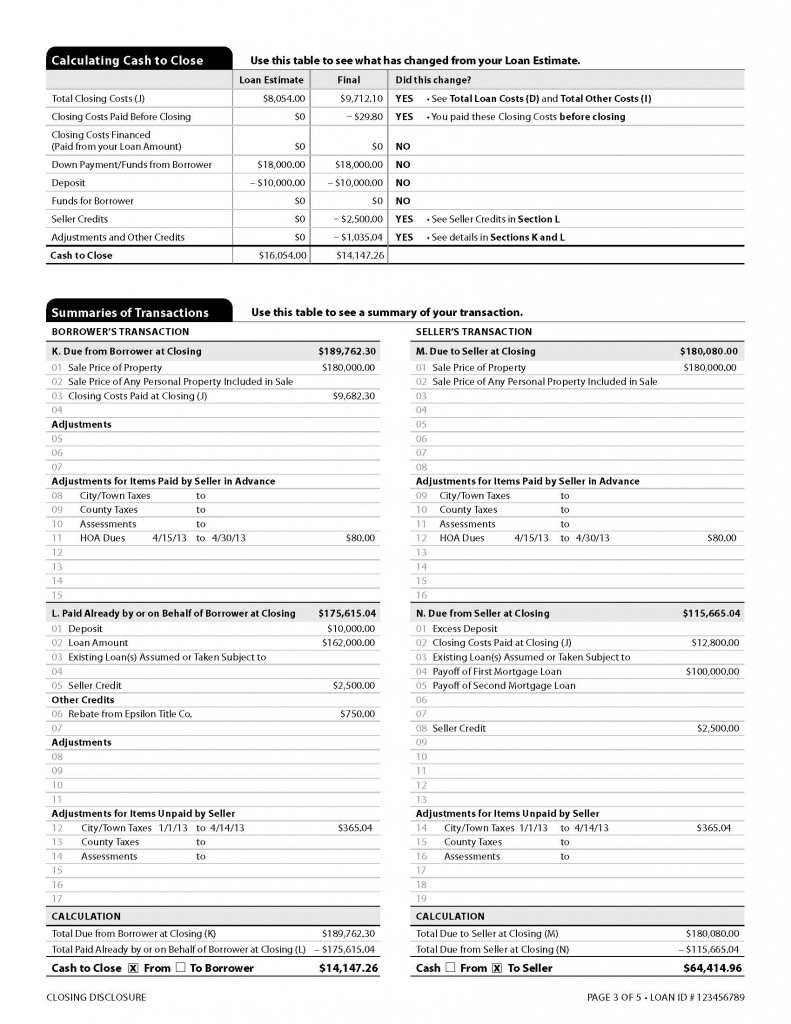

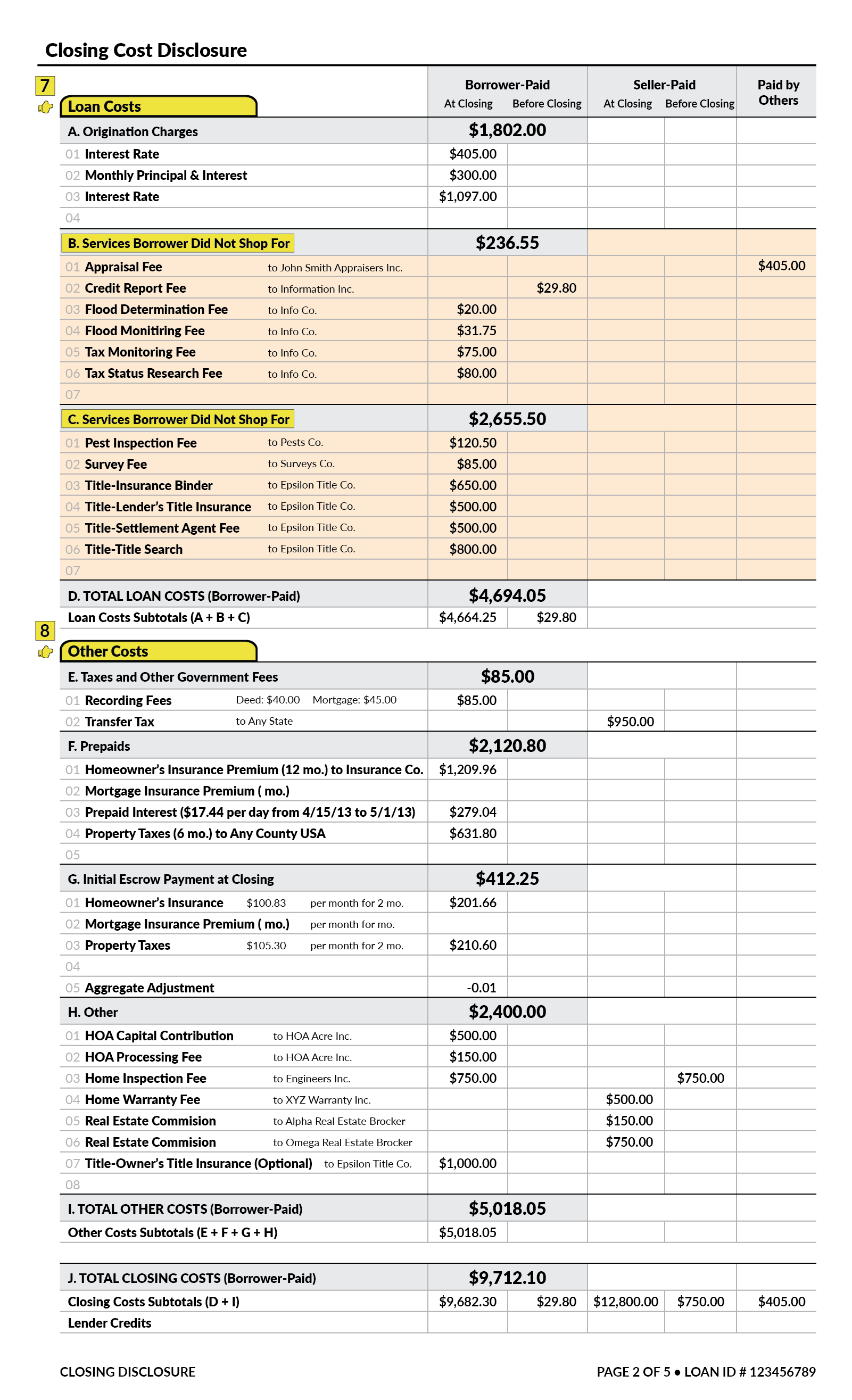

The Closing Disclosure - Example 2015

Military Lending Act Disclosure Form

How To Read A Buyers Closing Disclosure Floridas Title Insurance Company

Fdic Fdic Consumer News Fall 2015 - Sample Disclosures Consumer Financial Protection Bureau

How To Read A Buyers Closing Disclosure Floridas Title Insurance Company

The Closing Disclosure - Example 2015

The Loan Estimate And Closing Disclosure What They Mean - Nerdwallet

What Is A Closing Disclosure Lendingtree

How To Comply With The Closing Disclosures Three-day Rule - Alta Blog

Can I Get A Hud - Florida Agency Network

What Is A Closing Disclosure Lendingtree

Appendix G To Part 1026 Open-end Model Forms And Clauses Consumer Financial Protection Bureau

What Is A Closing Disclosure Lendingtree

Fdic Law Regulations Related Acts - Consumer Financial Protection Bureau